By 2020, 50% of Americans Are Expected to Be Independent Contractors (Freelancers)

I read an interesting article from Brian Rashid on Forbes.com. The article was titled The Rise Of The Freelancer Economy. In his article, Brian talks about feeling sorry for college graduates because they spend hundreds of thousands of dollars for a piece of paper (a college degree), then apply for jobs, then wait to get a job, while their debt increases. The bad news is that their skill set related to their college degree doesn’t start building until they get a career job. As Brian points out, the young professionals are getting into freelancing because they are ready for change.

“There are 53 million freelancers in America today. By 2020, 50% of the U.S. workforce will be freelancers (this does not mean they are all full-time freelancers, but one of every two workers will be freelancers in some capacity). This on-demand work, instant gig economy is moving more and more into independent professionals that are using mobile and technology to create ecosystems of work they enjoy. Who says you can’t drive an Uber in the morning, design websites all afternoon, and cater your own food company at night? The old economy would lead you to believe that you should pick one job, work hard for the next 40 years at that company, and then retire. Not the new economy. The more diverse your skill set, the more opportunities come your way.”

What are Independent Contractors or Freelancers?

Independent Contractors, sometimes called Freelancers, are independent workers, contractors, and temporary employees (full or part-time) who work for themselves. People in just about any career or profession can be Independent Contractors, such as Microsoft Certified Trainers, Uber drivers, artists, carpenters, software developers, photographers, network engineers, plumbers, video editors, sales persons, UPS drivers, public speakers, graphic artists, ethical hackers, authors, nannies, private investigators, etc. Independent Contractors have certain skill sets that they market and its common for them to work for multiple companies at the same time.

NOTE: The terms Independent Contractor, Independent Worker, and Freelancer are used interchangeably throughout this article. However, because the U.S. Internal Revenue Service (IRS) refers to Independent Workers as Independent Contractors, that’s the term I will primarily use in this article.

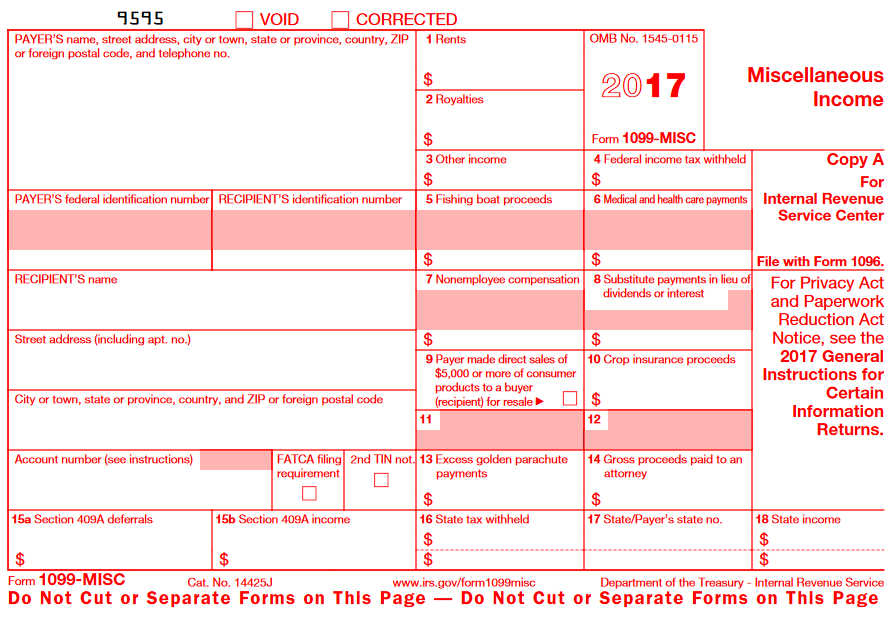

The Independent Contractors are self-employed and are therefore responsible for paying their own taxes. Because the employers report their annual income to the IRS on Form-1099 MISC each year, the Independent Contractors are often considered 1099-employees, to differentiate them from Full-Time Employees (FTE). Technically, they are not employees per se, but that’s quibbling over semantics.

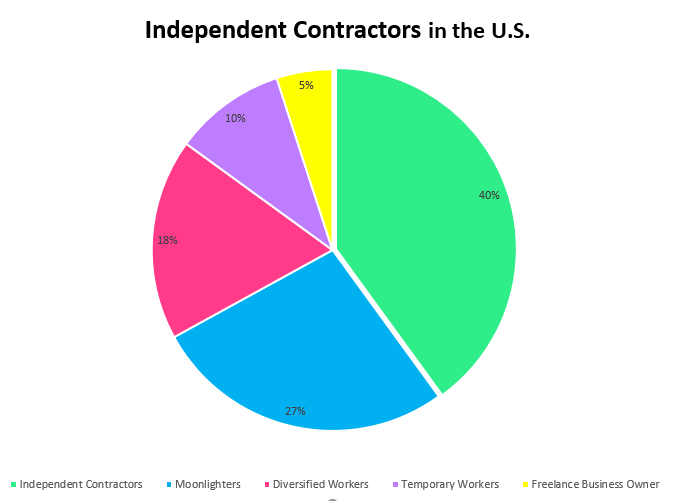

According to the Freelancers Union, there are 53 million freelancers in the U.S., which makes up 34% of the entire U.S. workforce. This large workforce is adding $715 billion to our economy each year. 77% of the people surveyed said they are making the same or more money than they did before they became a freelancer. The Freelancers Union defines the following five major categories of freelancers.

- Independent Contractors (40% of the independent workforce) 21.1 million professionals

This the largest category of freelancers and includes professionals who don’t have an “employer.” These people work full-time, part-time, or do temporary work usually as a 1099-contractor. - Moonlighters (27%) 14.3 million

This professional group has a full-time job, but they also moonlight on the side doing freelance work. For example, Boeing employees who do graphic design work on the side in the evening and weekends for fun, experience, or to supplement their income. - Diversified Workers (18%) – 9.3 million

Diversified Workers are essentially a combination of Independent Contractors and Moonlighters. This group of professionals has multiple sources of income from traditional employers and freelance work. For example, a full-time dental assistant who works as a nanny in the evening and writes articles for a travel blog on the weekend. - Temporary Workers (10%) – 5.5 million

These are individuals who work for a single employer on a temporary basis. For example, a construction worker who works on a housing project for a construction company for 6 months, or a software developer who works on a SharePoint project for an employer for 3 months. - Freelance Business Owners (5%) – 2.58 million

These are individual business owners who have between 1 to 5 employees and they also do freelancing. For example, an accountant who hires a few employees to offer her accounting services to the local businesses, but also offers services as a freelancer to other accounting companies who are essentially her competition.

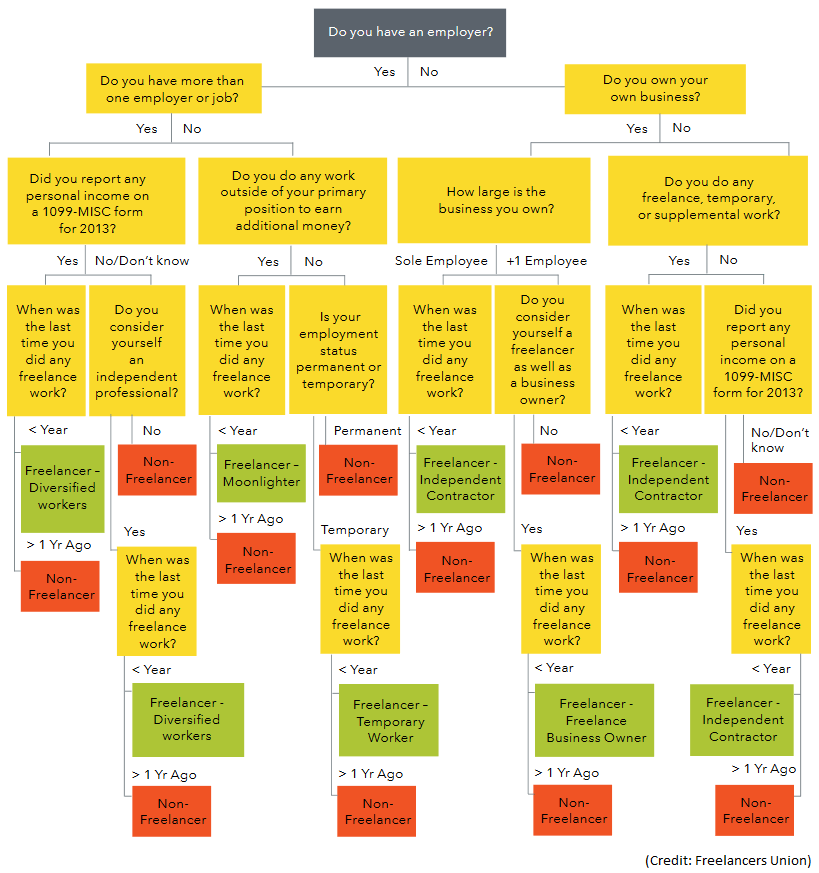

The questionnaire used by the Freelancers Union to identify the freelancer workforce was rather interesting. Here’s the questionnaire they used. I am sure they found it challenging to categorize the various types of contractors.

The above questionnaire helps you better understand the definition of each freelancer category. In my experience, the term Independent Contractor is used by a vast majority of businesses, probably because that’s the term used by the IRS.

The IRS Definition of Independent Contractor

Here’s the official definition of an Independent Contractor as defined by the IRS on its Web site.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors. However, whether these people are independent contractors or employees depends on the facts in each case. The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center.

You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). This applies even if you are given freedom of action. What matters is that the employer has the legal right to control the details of how the services are performed.

If an employer-employee relationship exists (regardless of what the relationship is called), you are not an independent contractor and your earnings are generally not subject to Self-Employment Tax.

However, your earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding.

For more information on determining whether you are an independent contractor or an employee, refer to the section on Independent Contractors or Employees.

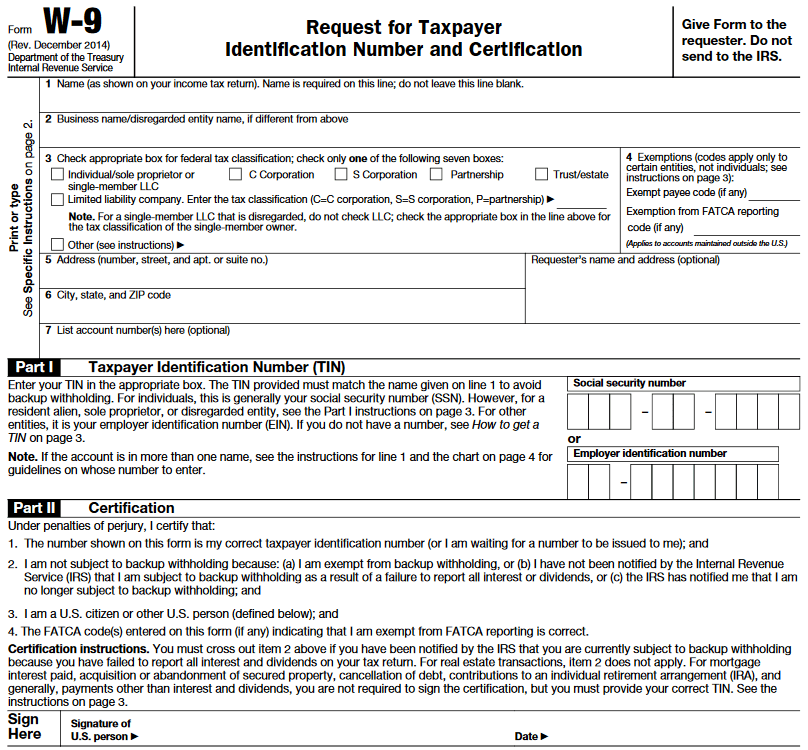

The employers use W-9 form to gather tax-related information from Independent Contractors, such as Social Security Number (SSN) from an individual or Sole Proprietor and the business name and Taxpayer Identification Number (TIN) from a business. The employer only holds taxes from the employees and makes payments to the IRS on behalf of the employees. However, Independent Contractors are not employees and are responsible for paying their own taxes. If the Independent Contractor makes $600 or more in a tax year, the employer reports the contractor’s income to the IRS on the Form-1099 MISC. The Independent Contractor then makes the tax payment directly to the IRS. A contractor may receive several 1099-MISC forms from multiple employers each year. The sum of all these forms is usually the net income of the contractor.

Top 10 Industries for Independent Contractors

Before I looked up the statistics, I was willing to bet all the tea in China that the #1 industry for Independent Contractors would be the computer and technology industry. Guess what? A survey by Flexjobs.com tracked 50 industries hiring freelancers between December 1, 2015 and March 1, 2016. The survey found the following top 10 industries for the Independent Contractors.

- Computer and IT

- Administrative

- Accounting and finance

- Customer service

- Software development

- Medical and health

- Project management

- Research analyst

- Writing

- Education and training

The Future for Independent Contractors

About 85% of my friends work as Independent Contractors, so when I read the statistic in Intuit 2020 Report (p. 21) that by 2020 freelancers will make up more than 40% of the workforce in the U.S., I wasn’t too surprised. Keep in mind, 2020 is only 2.5 years away. The report was published 7 years ago in October 2010 and its observations seems to be right on target. Here are some of the interesting trends observed in the report. The reference to “contingent workers” is made on page 5 of the report and is defined as “freelancers and part-time workers.”

- The number of contingent employees will increase worldwide. In the U.S. alone, contingent workers will exceed 40 percent of the workforce by 2020.

- Traditional full-time, full-benefit jobs will be harder to find.

- Small businesses will develop their own collaborative networks of contingent workers, minimizing fixed labor costs and expanding the available talent pool.

- Self-employment, personal and micro business numbers will increase.

- Government will misclassify workers, creating a major issue for companies of all sizes, especially in the first half of the decade. Work classification and work style will emerge as a target of intense political debate.

The Intuit 2020 Report, which was published in 2010, discusses about twenty trends that were expected to shape the next decade. In addition to the trends in work shifts from full-time to free agent employment mentioned above, I also found the trends related to working in the cloud to be very much on target:

- Smartphones, tablets and other mobile computing devices will become the go-to computing devices for most of the world.

- “Third places” for work will join the traditional office and home. The use of third places – public libraries, co-working facilities and rent-by-the-hour office suites – will continue to grow both in the U.S. and abroad, augmenting the already standard list of airports, cars and cafes.

- Enhanced collaboration and video services will transform the new workplace as distributed, virtual teams meet regularly using these new technologies.

- The globalization of talent will continue. Information and communications technologies will better enable globally distributed work.

Let’s take a look at some more interesting statistics related to the Independent Contractors.

- In her article, Sarah Alexander (no relation to me) points out that Upwork posts about 3 million jobs each year and facilitates more than $1 billion in annual freelancer earnings.

- According to Forbes’ 2016 Workforce Productivity Report, 96% of the CFOs surveyed said that they already hire Independent Contractors.

- A PwC report titled A future of work: A journey to 2022 envisions similar trends as the Intuit 2020 Report. It indicates that by 2022 “Contract employment will be king. Full-time jobs will become obsolete.”

- According to the survey conducted by the Freelancers Union and Elance-oDesk, there were 53 million people working as freelancers in 2014, which was 34% of the workforce. Their total contribution to the U.S. economy was $715 billion.

- According to Due.com, on average, Writers earn $58-$82 per blog post written, Designers average $52-$90/hour, and Programmers average $63-$180/hour. 71% of independent contractors are women, 28.9% are men.

What Does it Take to Be an Independent Contractor?

Working as an Independent Contractor is definitely not for everyone. From my personal experience, a vast majority of people who work as Independent Contractors in the IT industry absolutely love it and never want to go back to the traditional full-time job. Obviously, everyone is different. In my opinion, the number one requirement for an Independent Contractor is self-motivation. If you need to pep-talks, require listening to motivational speeches, and depend on other people to cheer you up, Independent Contracting may not be suitable for you. You also need to be very organized and disciplined in your life, both financially and in your work habits. On the other hand, if you have the entrepreneurial spirit, are confident, disciplined, organized, can live with a fluctuating monthly income, and are good at managing your finances, you can be a successful Independent Contractor.

If you have a career in IT, you have by far the best chance of having a successful career as an Independent Contractor and on average can make anywhere from 45% to 500% percent more than what you will make at your full-time job, depending on your experience, marketing skills, LinkedIn profile, and other factors. Yes, just like you are expected to wash your face and brush your teeth before you go to your full-time job each day, you are expected to have a LinkedIn profile with a professional photo if you are looking for work as an Independent Contractor, especially in the IT field. As one of the Microsoft Directors mentioned to me during a conversation about LinkedIn and its importance, “If people apply for a job at Microsoft and they don’t have a LinkedIn profile, as far as we are concerned they don’t exist.” In other words, if you don’t have a LinkedIn profile, chances are Microsoft won’t consider you for employment. This conversation took place long before Microsoft purchased LinkedIn. If you ever decide to become an Independent Contractor, the first thing you should do is make sure you have an up to date LinkedIn profile.

What are the Pros and Cons?

People work as independent contractors for various reasons. Some want to make more money, others want to work from home and setup their own hours. Before you consider freelancing, you should take a closer look at the pros and cons of becoming an Independent Contractor. The good thing is that working as an Independent Contractor doesn’t require you to quit your day job. You just want to make sure that there is no conflict of interest between your contract work and your full-time job.

Here is a partial list of some pros and cons of working as an Independent Contractor.

Advantages

- You are your own boss and can you set your own schedule. You can work as little or as much as you want. You can work weeknights and/or weekends, depending on your profession, and take time off during the weekdays.

- Depending on the type of work you do, you can work from home and can avoid the stress associated with the daily commute.

- You can work part-time while you build your own business and then decide if you want to work full-time for yourself.

- You will have many tax benefits and can deduct costs associated with home-based business (travel expenses, equipment, insurance costs, entertainment and meals, and much more).

- You are likely to pay a lower income tax.

- You are likely to make more than you made as an employee because your employers don’t have to pay you unemployment compensation, Social Security taxes, or benefits (medical/dental insurance, paid vacations, etc.). As an example, if you made $25/hour as an IT consultant and your company charged $125 for your services, as an Independent Contractor you will be making 4 times more if you were to charge the same rate.

- You can take time off for vacation, child-birth, illness, etc. whenever you want.

- You can expect a good work/life balance and your stress level is likely to be very low.

- You won’t have any restrictions or upper limits on your income.

- You can work for as many companies as you want and can try new areas of expertise to supplement your income.

Disadvantages

- You will have to pay for insurance (health, business and/or professional liability insurance, etc.) from your own pocket.

- You may have some startup costs (equipment, business cards, Web site, marketing materials, etc.).

- If you are not a self-motivating person, you’ll have find a way to motivate yourself. There won’t be a boss or other employees to motivate you.

- You won’t receive the benefits that you received as an employee.

- You will have to look for new clients and sell your services on a regular basis to the same or new clients.

- Your work is not guaranteed so your income may fluctuate, which will require some financial planning.

- You will be responsible for your administration work and accounting. Of course, you can hire an accountant but that will add to the cost of doing business.

- You can be held liable for your work, that’s why you need professional liability insurance.

Helpful Resources

If you are interested in working as an Independent Contractor, I strongly recommend reading the Independent Contractor definition on IRS’ Web site. Here are a couple of links that you will find useful.

- IRS Definition of Independent Contractor

- Tax Tips for Independent Contractors

- Freelancers Union

- The Ultimate Guide to Freelancing

Have you ever worked as an Independent Contractor? What was your experience and do you have any suggestions for others who may be considering it?

| Thanks for reading my article. If you are interested in IT training & consulting services, please reach out to me. Visit ZubairAlexander.com for information on my professional background. |

Copyright © 2017 SeattlePro Enterprises, LLC. All rights reserved.